5 Advantages of Successful Algorithmic Trading Strategies

Algorithmic trading strategies – which are also known by the monikers algo trading, automated trading and black-box trading- utilize a computer program to follow a distinct set of instructions to enter or exit a trade. The trade, in theory, can generate profits at a speed, as well as frequency, that is unfeasible for a human trader. In addition, trades can be placed in many different markets simultaneously, which no human trader could reasonably do.

The distinct sets of instructions in a trading algo are based on timing, cost, quantity, indicators, patterns or really any arithmetic model, as long as it can be programmed. Separately from revenue opportunities for the trader, algo trading offers markets more liquidity and volume. For traders, one benefit is that algorithmic trading allows for more logical decision making – by reducing the impact of human emotions on trading activities.

Advantages of Algorithmic Trading

Successful Trading Strategies offer the following advantages:

- Speed And Accuracy

Trade order placement is immediate and accurate. In the old days, especially in the futures trading pits, a trader would first call the broker, give the order over the phone, and then wait for 1-10 minutes to find out if he received a fill. Even then, at the end of the day, sometimes fill prices would mysteriously change, as the floor participants tried to match trades. It is funny, but I remember fill changes almost never working in my favor. I wonder why that was – LOL!

Today’s markets are all electronic, and have dramatically reduced the possibility of errors in trades. Most of the errors I encounter in trading these days are of my own doing!

- Trade Timing

In the days of old, a trader would sit down at night, look at a chart, draw some trendlines, perform calculations of standard indicators and then place buy and sell orders for the next day. Speed was not a consideration – everyone traded off of daily charts, and usually flooded the market with orders at the open.

In 2021, this is a different trading world. Traders use algos to make instantaneous decisions on all sizes of bars, not just daily bars. Speed – rapid calculation, rapid order placement, rapid fill notification – is all part of the algo trading progress. In fact, it is definitely one of the major benefits. Money can be made (or lost) more quickly than ever.

- Reduced peril of manual errors when placing trades

As mentioned earlier, in the old days you had to enter order via phone. So there was a lot of opportunity for errors. In the current markets, the chances for error rest almost solely upon the trader. He or she is the one who enters the order, so is the one usually making the mistake. That is why algo trading can be so powerful. A properly programmed algo will not make “fat finger” mistakes or produce other shenanigans that manual traders routinely experience.

- Algo-trading can be back tested utilizing accessible historical and real-time data to see if it is a feasible trading strategy

This is a huge benefit of algo trading. The theory here is that a strategy which is historically profitable is likely to remain profitable in the future. Of course, there is no guarantee here. After all, the US government wisely warns traders “past performance is not indicative of future results.” That is absolutely true.

So how can one develop an algo strategy that performs well historically AND (more importantly) in real time? That is a million dollar question, one algo traders have been striving to answer for many years. It almost seems easier to create a losing algo strategy than it is to create a winning one!

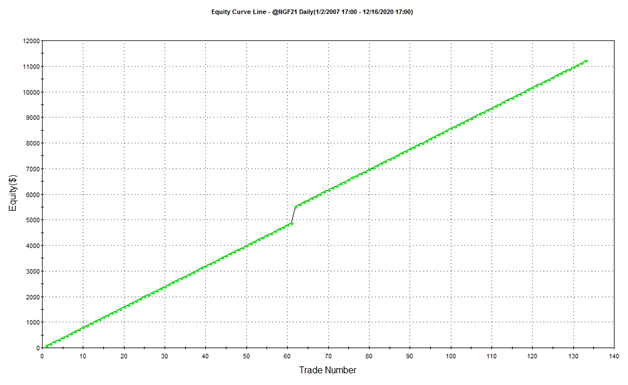

For example, if you were to take a strategy, program it in a trading platform like Tradestation, and optimize a few of the parameters, you could get a great looking back test – maybe something like the equity curve shown below.

Figure 1- A Great Looking, But Possibly Over-Optimized, Trading Algo

Without a doubt, this strategy has performed amazingly well over the past 14 years. But is that because it is really a good strategy, or is it because it happened to be the best performing strategy out of 10,000 candidates? The answer to that question is usually the difference between profit and loss. In other words, an optimized strategy may look nice historically, but is also likely to fail in real time.

The key then with developing algo trading systems is to have a solid strategy development process – one that minimizes “bad” features such as over-optimizing and curve fitting. This is tradecraft knowledge accessible to qualified traders through advanced level algo trading masterclasses. Most traders do not even realize this information exists!

- Reduced opportunity of mistakes by human traders, based on psychological factors

As long as there has been trading, there has been emotion. It all comes down to money. If money is involved, you can be sure people are going to be emotional about winning and losing it.

Some traders mistakenly think that algo trading is emotionless. I always laugh at this – the assertion is blatantly false. Those who confidently state “algo trading is trading without emotion” fall into one of two camps: non-traders (those without a real money trading account), and sim traders (those trading on a fake money simulator).

I know plenty of sim trading millionaires, but not many real money trading millionaires. There is a reason for that!

That all being said, algo trading can be less emotional for traders in the heat of the moment. Since the computer algo makes the trading decisions, the trader’s stress of buy and sell decisions dissipates. However, the emotions now move to different areas. Instead of worrying about buy/sell decisions, the trader instead has to worry about turning on and off particular algos. This can be just as stressful, if not more so!

All things considered, algo trading can help with trader emotions. And a less emotional trader tends to be a better trader. But emotions can never be eliminated, as long as real money is on the line.

Wrapping Up

This article has detailed five of the major advantages of algo trading. While algo trading is not for everyone, it can be ideal for those with a mathematical, technical or managerial mindset. On the other hand, for those traders who rely on intuition and feelings, algo trading might not be the best path to profitability.