What is Robot Trading?

“Danger, Will Robinson.” If that quote looks familiar, then you are old enough to remember the television show “Lost In Space.” The robot in the show was a major character, and he was prone to glitches and other issues. That kind of robot cannot help you trade!

Figure 1- NOT A Trading Robot!

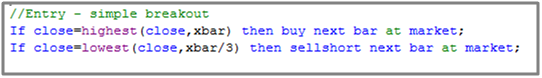

Robots for trading are simply computer programs or algorithms that execute a range of automatic trading functions, from informing traders when to trade, to situating and supervising trades on behalf of their user. Here is an example of a simple algo written in Tradestation’s Easy Language:

Figure 2- Code For A Simple Trading Robot

In its simplest form a trading algo or robot has a rule to buy and a rule to sell (or sell short). Complicated trading robots can have multiple buy and sell rules, and can include position sizing, money management, profit taking and stop loss features in them.

The basic idea with robot trading is that it does the trading for you, allowing you to spend time creating new and improved robots.

Robot trading can be programmed to trade around the clock, or really any hours you choose.It creates trading signals, or triggers for action, which are based on scrutiny of historical data. Robot trading can be willingly bought online – and it is not hard to understand why traders would be attracted to the idea of installing a program that will mechanize trades on their behalf. Having a robot trade for you definitely has advantages, but it also has disadvantages. Both of these will be discussed later.

Types of Robots

There are various types of algos (robots) that can be deployed on the stock, futures, forex and even crypto markets. Some robots are designed especially for large professional traders. An example of this type of robot would be one that slowly buys or sells millions of shares in the stock market. A robot designed for this purpose will be programmed to achieve the best price possible, while not upsetting market balance for such a big order. Think about it – sending an order to sell 1 million shares all at once would cause temporary chaos! But slowly filling the order – which a robot can do – will prevent a large market price disruption.

For the typical retail trader, the choices of robots are quite a bit simpler. You can administer some of these characteristics of robots by selecting among the two primary different types:

Automatic: These are robots that do everything; you just open them or attach them to a price chart and they will enter as well as close trades at any time as per the parameters you set. You do not have to intervene at all, except if the robot gets out of sync, or a rollover is necessary (futures markets).

Semi-Automatic: The robot will do everything short of really opening or else closing the trade. Typically, it will show you the details it has planned and what you should follow in terms of entry-level, stop loss and take profit. But then you decide whether or not to take the deal. While some people do this successfully, many do not – these traders overrule what become good trades, and accept what are bad trades!

Advantages Of Robot Trading

Trading with robots has some definite advantages.

- You can test rules for yourself (no more relying on some alleged “guru”). You can do this BEFORE you trade in the markets with real money. This is a great advantage, because if you test your robot properly, you can know it made money historically. While this does not mean the robot will continue to make money, it is still nice to know upfront.

- You can create many robot strategies, automate them and take advantage of diversification. Your robot can be watching many markets, and can automatically trade whenever conditions are right, in any market you choose. You do not have to be watching 10 different markets simultaneously, and run the risk of missing a trade. A well designed robot or multiple robots can trade 5, 10, 20 or even more markets at the same time, without your intervention.

- You will have more confidence in your robot strategies, knowing they have performed well historically. You will therefore have more trust in the trading robots you deploy.

- You don’t have to be glued to a screen. Many traders watch each tick of the market and can’t leave their workstation during the trading session. Some are not even able to go to the bathroom! With robot trading, you still have to monitor the robot – making sure it performs the right actions – but you do not need to be tied to the screen. This can be a BIG advantage.

- You are in control – your robot can trade however you want (trade certain days, no weekends, certain markets/stocks, etc). A custom designed robot can fit your lifestyle or work schedule. You can have a full time job and not have to worry about your robot!

- You don’t stress about every single entry and exit. You can rest assured that the robot is in control. It will execute your rules, without mistakes (as long as the incoming market data is good), and your robot will be your faithful, emotionless servant. It does what it is told, and eliminates some of the trading stress you might otherwise have.

Disadvantages Of Robot Trading

Reading the above section, you might think that robot trading is a dream come true. Unfortunately, that is far from the truth! Robot trading definitely has some disadvantages:

- It is very easy to develop a robot the wrong way! Since you create the robot, if you make mistakes in developing and testing the robot, you will likely create a robot that underperforms and loses money. In fact, most robot builders do exactly this. They have no concept of how to properly create a robot, and therefore create one that is over-optimized and curvefit. These robots tend to perform poorly in the future. That is no fun!

- “Past performance no guarantee of future results”Just because a robot performed well historically, there is absolutely no guarantee it will continue to perform well. This trips up many traders. They do not understand why their robot fails – there can be many reasons for this. But a properly developed robot certainly improves the odds of success.

- Most people cannot resist “tweaking” their strategy – making a better backtest. Trading robots are made to be developed and traded without changes or interference. Unfortunately, most people disregard this advice. They will take a decently performing robot, and try to improve it by adding rules, filters and extra conditions. Or, they will attempt to optimize the robot until it shows better results. The problem is this approach usually creates great historical performance, but terrible realtime performance.

- Most people cannot resist overruling their strategy. Robots should not be overruled. Most traders think they are smarter than their robot, and therefore pick and choose which trades to take or not take. This is not a good approach.

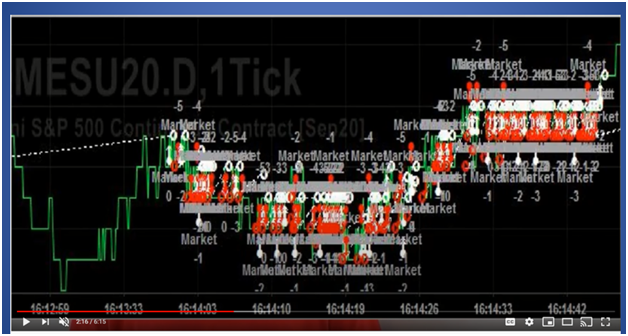

It is not “set and forget” like most people think (problems, outages, rollovers, splits, etc). Somehow, many traders think robot trading is something you can setup and walk away from. If only that was true! Robots must still be monitored.

Here is an example of a robot I had that went crazy one day, placing over 100 orders in a few seconds. This was due to a software glitch. It was a bit scary!

Figure 3- Robot trading run amuck!

- It takes hard work to succeed! Robot trading takes hard work. It is not easy, nor is it for everyone. But a trader can achieve good risk adjusted returns with a robot – if they are willing to put the work in.

Can I Buy A Trading Robot?

There are people out there who sell trading robots, supposedly ready for use. They will even show you beautiful looking equity curves. Don’t be seduced by these equity curves.

Before you buy a trading robot, be sure to do a thorough investigation of the robot developer. Ask a lot of questions, and demand performance proof.

Most robots available to the typical retail trader are probably junk. So, be careful before you risk your hard earned money.

How To Get Started

If you decide robot trading is for you, here are some steps you can take:

- Research Platforms, Brokers – You need software to test your robots. Tradestation is a great platform to use, but there are many other options too. Make sure you have a broker that supports whatever markets you plan on trading.

- Read Algo (Robot) Strategy Development Books– Pardo, Tomasini, Chan and Kevin Davey all have good books in this field.

- Get Advanced Help If Needed – Building a robot is tough, especially for intermediate traders (if you are a beginner, don’t even try to create a robot. Get some trading experience first). Luckily, there are a few options for you to really improve your strategy building process.

- Start Developing Robot Strategy #1 – The best way to learn trading robot development is to actually develop a robot. Things will be a lot clearer once you actually practice by creating robots.

Wrapping Up

So, I have just given a great overview on robot trading. Armed with this information, you should be able to go and start digging into this potentially lucrative endeavor. Good Luck!