How Can You Be Successful With Algo Trading Strategies?

The lure of easy money tempts everybody, but financial matters aren’t a simple nut to crack. The world of finance is multifaceted and you need skill to succeed at it. Sure, every once in a while you hear about a janitor with no financial education leaving behind a multi-million dollar stock portfolio, but those cases are few and far between. Investments, trading, returns, etc. are not a simple matter.The financial world is complex.

One area where many people attempt to make money is thru trading. In its simplest form, trading is buying an asset at a low value, and later selling it at a higher value. Sounds easy, right? If that were only true!

Figure 1- Easier Said Than Done!

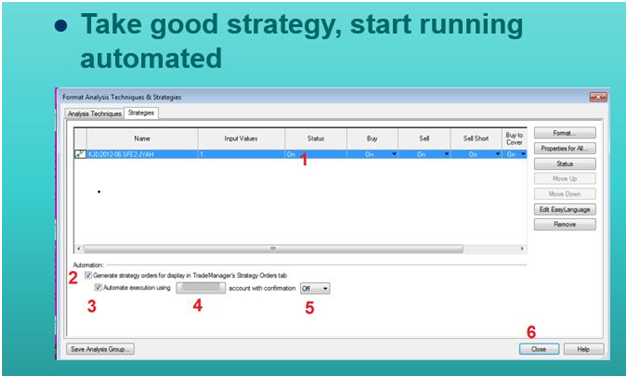

Figure 2- 6 Steps To Automate An Algo In Tradestation Trading Platform

The truth is many people go broke trying to trade. Just google “trading failures” – over 42 million hits pop up! A lot of people obviously fail at trading.

At the same time, though, there are ways to succeed in trading, whether you are trading stocks, forex, futures, crypto or options. One method of trading that can lead you to success is the world of algo trading. Algo trading systems, or algorithmic trading, is a method of trading where a computer makes trading decisions, as opposed to a human.

Many such examples occur where a human trader is incapable to quickly handle the large number of calculations involved in a trading system. For example, in the time it might take to calculate moving averages by hand, the trading opportunity may already have passed.

A trading algo can produce advantages at a speed and frequency that is unfeasible for a human trader. So, there are many instances where you need to search for help from an intellectual or smart algorithm. This is where the Algo Trading Strategy system approach comes into the picture.

What is Algo Trading?

Algorithmic trading is the process of using computers programmed to pursue a defined set of instructions to trade in the financial markets. Put another way, algo trading is simply programmed rules to buy and sell.

An example of such an algo would be to buy, at 9:30 AM every morning, all stocks that closed at a 52 week high the previous day. The thought here is that stocks at new highs are likely to keep rising higher. This could be due to a well-run company, popularity amongst other traders, or general stock “bull” market conditions.

These trading algorithms can actually take trades for you, if you wish to do it automatically. This is referred to as automated trading, and if you have the right trading software (as shown with Tradestation trading software below), automation of an algo strategy is fairly routine – a 6 step process.

How Can You Learn To Create Successful Algo Trading Strategies? There are quite a few excellent books on algorithmic trading:

These books can give you a solid foundation in algo trading. But at some point, you’ll likely realize that you could benefit from a trading master – someone proven to be a successful algo trader.

You can really accelerate your algo trading acumen by attending an Algo trading masterclass. This is the short name for an algorithm trading masterclass. Some people might also refer to this type of trading as

- automated trading

- black-box trading

- rule based trading

- mechanical trading

- systematic trading

Whatever you call it, the general idea is the same – have the computer perform the calculations, and make the buy and sell decisions, for you.

In an algo masterclass, which can be considered the Ultimate in Algo Trading Education, you will learn the proper way to develop and implement algos. Such a class could provide you with a solid education in the field. Trust me, taking an algo class is a much better way to learn than losing money in the markets!

In case you are still unsure of the benefits of algo trading, here is a quick summary of the major ones:

Speed

Algorithms are compiled in advance so they can run practically instantaneously on any market you desire. The prime benefit of doing this is speed. The speed is fast to the point that it is tough to take note of as an individual. Orders can be sent to the exchange at lightning speed, which is especially important during breaking news events.

You can scrutinize and execute diverse algorithmic indicators, such as RSI, moving averages, Bollinger Bands, and price patterns such as candlesticks at an immediate speed that is hard to beat. This can lead to market edges – Successful Algo Trading is based around this premise. You create rules and have your algorithm perform fast calculations that lead to market profits, within acceptable risk levels.

Accuracy

Precision is vital in algorithmic trading. Much like any other business, precision is the key to getting superior outcomes. Once properly programmed, the algo does not make mistakes. It just does what it is told – how refreshing!

Emotions

If your current trading is dominated by thoughts of “should I take this trade?” algo trading might be able to help you. While true algo trading does not eliminate emotion, it can take away and transform the stress over individual buy/sell decisions. Simply let the computer make the decisions, and then the trader can worry about other trading related topics.

Objectivity

If you despise staring at a chart, wondering if you see a pattern, trend or turning point, algo trading can help. With algo trading, you can precisely define patterns, turning points and trends. No more guesswork! As long as you can define it in computer code, the algo can identify whatever you wish. That is a great way to remain objective. A turning point today will still look like a turning point tomorrow. Many traders find this consistency key to their trading success.

Wrapping Up

Algo trading is not easy, but then again no trading is easy. Each different type of trading has its pros and cons – its benefits and disadvantages. But for many people, algo trading is a great way to achieve reasonable risk adjusted returns, with precision, speed, objectivity and consistency. It is clear that algo trading has many features that other standard approaches to trading do not.

But to really learn algo trading, it is advisable to find a masterclass in algo trading. That is a great way to learn to algo trade, while potentially avoiding crippling market losses.