Welcome To

The Trading Master Class

The Ultimate in Algo Trading Education

Take Your Trading To The Next Level!

Here’s the brutal truth about trading

Trading is HARD!!

I’ve always said it is the hardest way to make easy money…

And trust me when I say that in the early years I failed, and failed a lot.

But after many years of trading failure, in the early 2000’s I discovered “algo” trading. This is trading based on a set of rigidly applied, backtested rules. Once I fully embraced algo trading, a few years later I was a 3 time trading contest trophy winner…

I now use a standardized process to build my algorithmic trading strategies – a trademarked process I call the Strategy Factory®.

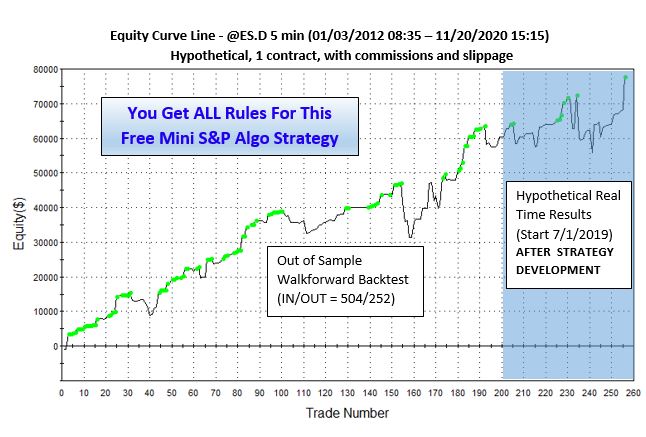

I used that process to build this trading strategy for the mini S&P futures:

So to succeed in trading you need a solid development process – one that guides you in building strategies correctly. I provide this algo trading education in my Algo Trading Masterclass – I call it the “Strategy Factory Workshop.”

The best part? Proper algo strategy development can be a simple, 8-step process.

The process takes hard work. But it’s not complicated. And it’s one of the fastest ways I’ve discovered to quickly build a portfolio of algo trading strategies.

My trading masterclass is called the Strategy Factory workshop.

If you want to get access to a free mini S&P Algo Trading Strategy – a real-life case study of the Strategy Factory in action – just enter your name and e-mail address above and I’ll send it over. I’ll also include some great trading entry and exit ideas you can start testing on your own – TODAY!

Claim the FREE S&P algo strategy shown above – with all rules fully disclosed – along with the 2 books shown below. Simply enter your information at the bottom of the page. You will not regret it!

What is a trading masterclass?

A trading masterclass is in-depth instruction provided by an experienced and successful trader. This type of class is for intermediate to advanced traders.

What are algo trading systems?

An algo trading system (some call it robot trading) is a set of rules that dictate when to buy or sell a financial instrument. Such rules are usually computerized into what is referred to as an “algorithmic trading strategy.” Such rules may also be automated.

What skills do I need to create trading systems?

What should I look for in trading education?

What are major pitfalls when building trading systems?

The most common pitfall in trading systems development is overfitting or curvefitting – creating rules that produce great looking historical backtests, but almost never work on future data. Neglecting slippage and commissions is another major pitfall.

Is using a trading system better than other types of trading?

Data, information, and material (“content”) is provided for informational and educational purposes only. This material neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities. Any investment decisions made by the user through the use of such content is solely based on the users independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Neither TheTradingMasterClass.com nor any of its content providers shall be liable for any errors or for any actions taken in reliance thereon. By accessing this site, a user agrees not to redistribute the content found therein unless specifically authorized to do so.

Individual performance depends upon each student’s unique skills, time commitment, and effort. Students sharing their stories have not been compensated for their testimonials. Student stories have not been independently verified. Results may not be typical and individual results will vary.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission. Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Testimonials appearing on this site are actually received via email submission or web survey comments. They are individual experiences, reflecting real life experiences of those who have used our products and/or services in some way or other. However, they are individual results and results do vary. We do not claim that they are typical results that consumers will generally achieve. The testimonials are not necessarily representative of all of those who will use our products and/or services.

The testimonials displayed are given verbatim except for correction of grammatical or typing errors. Some have been shortened, meaning; not the whole message received by the testimony writer is displayed, when it seemed lengthy or the testimony in its entirety seemed irrelevant for the general public.